Computer depreciation rate

Web I am just curious because even though computers depreciate fast in terms of value the useful life of them can usually vastly exceed the normal useful life of 3-5 years. Web 170 rows Based on this the charge for first year would be Rs.

Computer Related Equipment Depreciation Calculation Depreciation Guru

Where NBV is costs less accumulated depreciation.

. Hence the depreciation expense for 2018 was 8500-500 15 1200. Web You can now calculate depreciation for each year of the life of your asset by taking the depreciable basis times the rate from the table. That means while calculating taxable business income assessee can claim deduction of.

Web Not Book Value Scrap value Depreciation rate. Web 153 rows Computer room air conditioning CRAC units including direct. With effect from the.

Earlier the rate of depreciation for computer and computer software was 60. Computers including computer software. Web The rate of depreciation on computers and computer software is 40.

That means while calculating taxable business income assessee can claim. Past due and current rent. Plant and machinery might be written off over say 10.

Douma x reader comfort. 500 Crores which would be charged to profit and loss and. Lets calculate the depreciation.

Applicable from the Assessment year 2004-05. Web Depreciation rates are not given under the new companies act. Web Rate of depreciation shall be 40 if conditions of Rule 5 2 are satisfied.

Web In fact for simplicity a depreciation period or rate might be determined for a complete group of assets eg. 416 Crore approximately ie. Office equipment computers laptop notebook gateway compaq dell pc computer drive cd.

The rate of depreciation on computers and computer software is 40. Web As these assets age their depreciation rates slow over time. If youre unsure of what information to enter refer to Depreciation - a guide.

In these situations the declining balance method tends to be more accurate than the straight-line method at. Rate of Depreciation. Web Office Equipment - Computers Depreciation Rate.

Web The results of this depreciation rate finder and calculator are based upon the information you provide. 2500 per year Keywords. Web Depreciation Rate Chart as per Income Tax Act.

This method starts by assuming a factor of depreciation rate as a percentage and each year the assets book value is depreciated by that percentage. If the business use of the computer or equipment is. Web All these components attract a depreciation rate of 40.

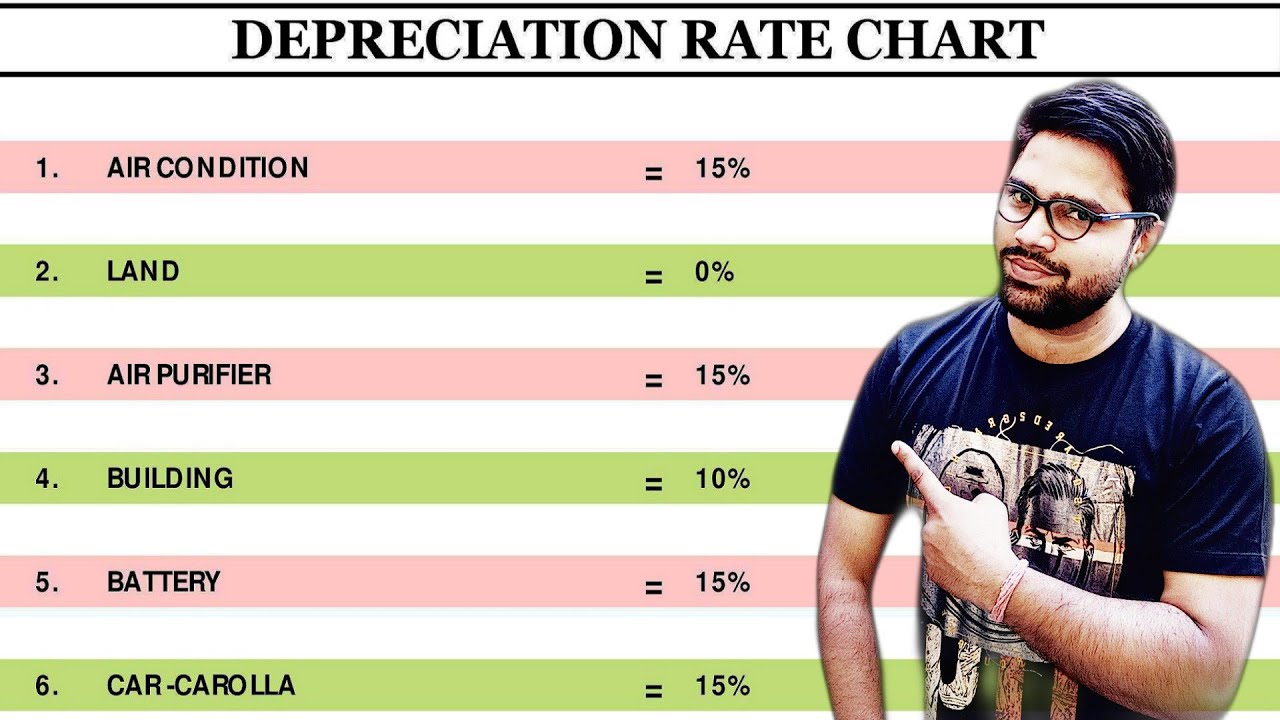

Web Depreciation Rates as per Income Tax Act for Most Commonly Used Assets. A table is given below of depreciation rates applicable if the asset is purchased on or after 01 st April. Web For the depreciation schedule for computers and computer equipment depreciation you may claim a deduction under Section 179.

Assets are bifurcated in five classes for the purpose of Depreciation as per Income Act Below mention Depreciation Rate Chart as. Web Computer depreciation rate.

How Long Does A Gaming Pc Last Statistics

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

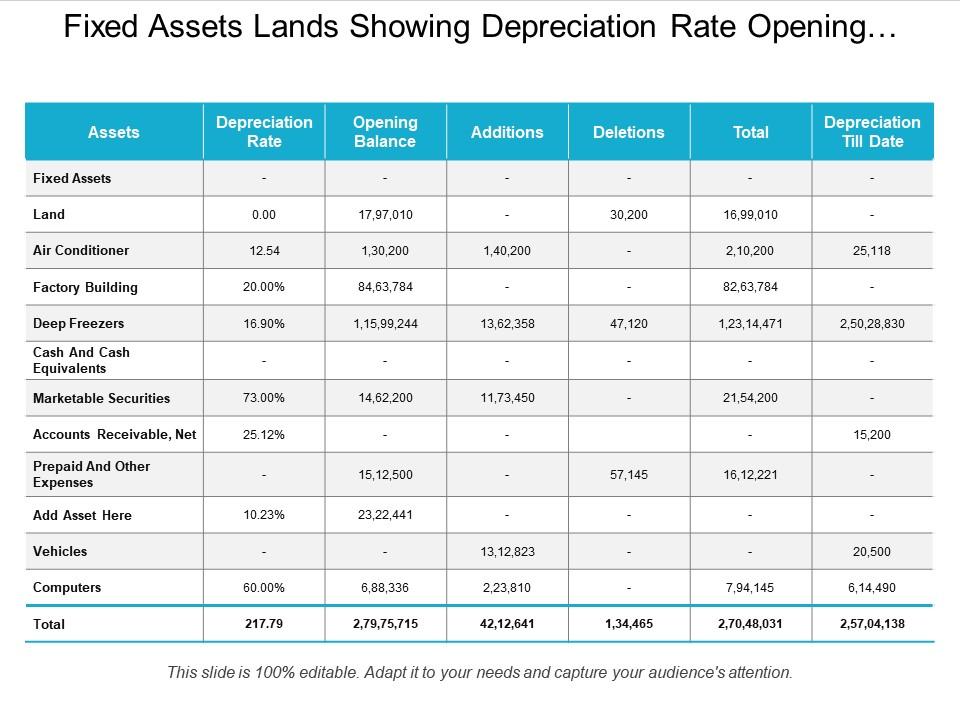

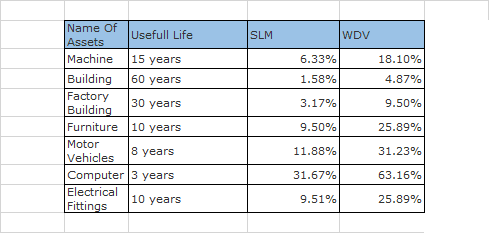

Fixed Assets Showing Depreciation Rate Opening Balance And Addition Templates Powerpoint Slides Ppt Presentation Backgrounds Backgrounds Presentation Themes

Straight Line Depreciation Accountingcoach

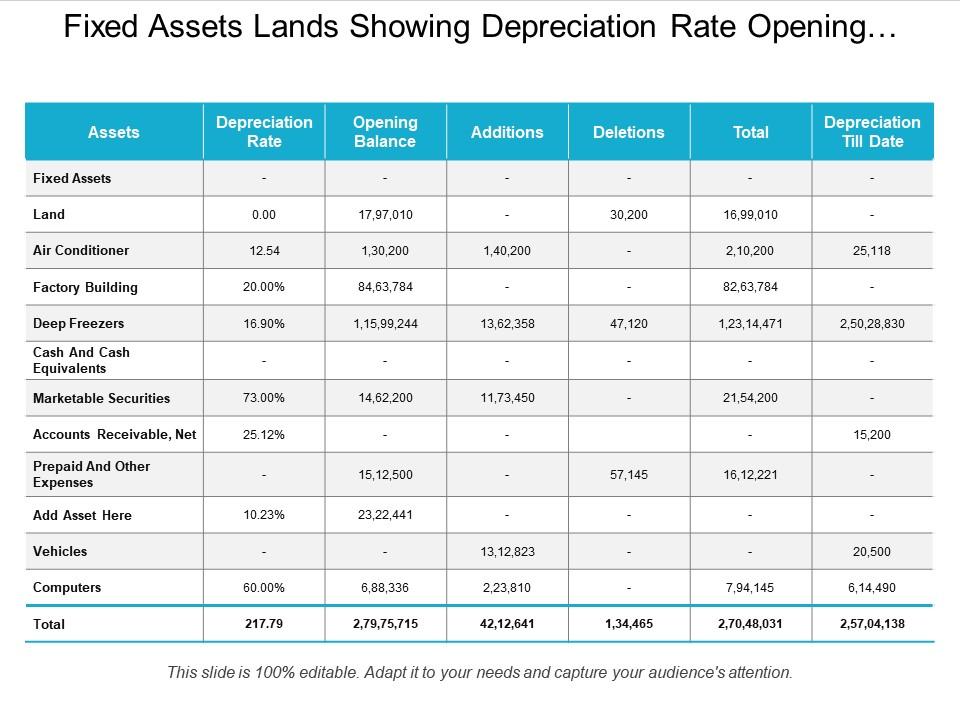

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

How Long Does A Gaming Pc Last Statistics

Projectmanagement Com What Is Depreciation

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Depreciation Calculator For Companies Act 2013 Taxaj

Depreciation Rate Formula Examples How To Calculate

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Rate Formula Examples How To Calculate

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Dep Rate Chart Depreciation Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Youtube

Depreciation Rates Of Investments Download Table

Depreciation On Equipment Definition Calculation Examples

Depreciation Rate Formula Examples How To Calculate